BLOCKCHAIN: FIFTH WAVE OF DISRUPTION FOR BANKS - PART 2 (RELEGATED MIDDLEMEN)

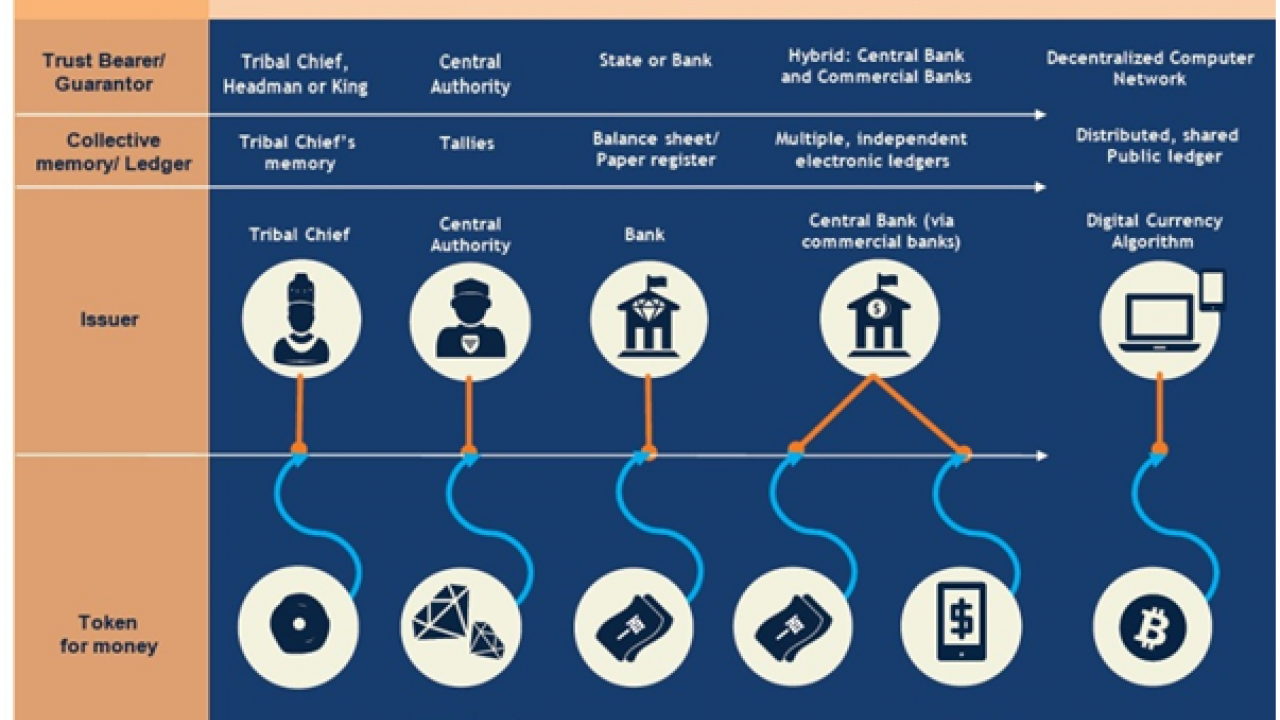

In the second part of the blog series lays out the disruptive potential of blockchain for financial services and how intermediaries end up with diminished roles. Proponents of the technology say that the scale of business transformation will be similar to that of the internet. The birth of the internet enabled exchange of data whereas world-wide adoption of blockchain will enable exchange of value e.g. trade, commerce, commodities etc.

The Fifth Wave

In recent history there have been four major technological game-changers for banks. The first technological disruptor was in the form of mainframe and personal computers that led to the first transformation of the banking industry with increased data storage and on-premise processing capabilities that boosted efficiencies across the board. The second wave was in the form of internet that took data access possible at the click of a button and hence allowed free flow of data around the world which made banks flush with useful and real-time information. The Third Wave was in the form of cloud computing that allowed banks to offload complex and cumbersome data processing offshore ensuring computing power was efficiently exploited on distributed platforms. Then came the fourth wave in the form of smartphones & associated apps that banks are still reeling under which has lowered the barriers of entry and created nimble banking startups powered by technology called Fintechs. The fifth wave that has further disrupted the banking landscape is the introduction of blockchain technology.

Financial Uses

From a banking standpoint the biggest advantage blockchain provides over traditional centralised system is disintermediation.

Payments/Remittance & Currency Exchange

In a traditional payments system, inter-bank payments are performed using a central counterparty and every bank has a local database which are not reconciled accurately. Also payments are performed by settling net obligations throughout the accounts recorded by a central counterparty. In addition cross border payments use multiple central counterparts (for different payment networks) and correspondents banks, where each bank has to maintain a reserve account with multiple payment networks.

Adoption of blockchain creates a instantaneous RTGS since execution happens in real-time in a peer-to-peer fashion, reducing counterparty risk, saving transaction costs and lowering settlement time to seconds (from the usual 2-3days). Striking out cental counterparts and correspondent banks from the chain and lowers capital requirements associated with such intermediaries freeing up financial resources for banking business. Also, it improves transparency and does away with reconciliaton of different databases, since a single ledger authorative state is obtained by consensus making compliance easier as access would be graned to regulators and auditors. Examples: Ripple - cross-border payment systems, Abra – P2P money transfer, Bitspark – end to end blockchain powered remittance services, Align – Payment Service Provider (PSP), Hellobit – bitcoin based remittance service for emerging markets, BitPesa – B2B payments

KYC/Identity Management

Know Your Customer (KYC) is a regulatory constraint that requires banks/financial institutions to verify client’s identity which is time consuming and requires lots of paperwork resulting in significant overhead costs. Moreover KYC involves storing and verifying documents pertaining to the client. Creation of SWIFT interbank registry was an attempt to centralise access to reliable data about customer’s identities.

Blockchain can significantly speedup the KYC process and save costs, by having a single cryptographic identity for every customer whereas customer data e.g. identity cards, passports, driving licenses etc securely and digitally loaded on to the blockchain available to all the banks. Documents once validated and authenticated will not need any further diligence hence saving the repeated verifications Also digital docs can be assigned a block-chain defined fingerprint which the banks can receive as proof of verified document to complete the KYC process. Examples: Tradle – KYC portability, Vogogo, Civic, Credits

Trade Finance

Financing of domestic and international trades involves two counterparties (seller and buyer of goods) and a third parties (bank/financial instution) to reduce two types of counterparty risks: (i) for buyer: sender not fulfilling good’s sending (ii) for seller: buyer not paying. Trade finance is complex and time consuming and involves the following processes: contract signing, buyer’s bank supplying LoC (letter of credit) to seller guaranteeing payment, seller receives Bill of Lading when goods are given to carrier, seller receives payment after giving bill of lading to bank, bank gives bill of lading to buyer who receives goods after showing it to carrier.

Blockchains can be used to dramatically automate and speed up the process by using smart contracts. Settlement via LoC process takes days which can sped up by embedding the LoC rules within the smart contracts. Also the blockchain will have buyer/seller account with funds and intera ctions between buyer and seller can happen real time as per the smart contract. Once carrier confirmation obtained as goods are sent this will automatically trigger release of funds to seller. In future IoT devices with sensors can be integrated to the blockchain to monitor the state of goods. Examples: Fluent, Skuchain, Tallysticks, Wave, Consentio, Chain of Things, Zerado

Securities Trade Lifecycle

Ideally securities trading life cycle takes about three days from trade execution to settlement and consists of 3 major steps:

Trade Execution: buyer/seller request orders to their respective brokers who can act on client’s behalf to submit orders on a exchange. Confirmation is sent to buyer/seller via broker when buy/seller orders are matched in terms of price and volume.

Trade Clearance: buy/sell orders are sent to a central clearing house which acts as buyer to seller and as seller to buyer. By doing so the clearinghouse guarantees trade execiution for both counterparties and removes counterparty risk from the trade.

Trade Settlement: buy/sell obligations are settled using netting which involves grouping orders into a single net transaction using the custodian as an internediary. Finally buyer settles his obligation with the custodian receives securities and seller gets paid.

Private blockchain controlled by consortium of clients, brokers and clearing firms as participants can have clearance and settlement being done on the blockchain which also serves as a depository of securities stored as digital assets rules and securities (bonds, shares etc.). Buy/Sell orders from clients are put on the blockchain by the brokers through smart contracts which automatically handle trading, matching and execution. Most importantly central clearing house as an intermediary loses relevance. Payments can be managed directly from the client accounts registered on the blockchain. Clearance and settlement rules are encoded within smart contracts eliminating reconciliation between participants thereby reducing clearing and settlement time from a T+3day cycle to minutes. The doing away off 3-day waiting period makes custodial services irrelevant and minimises complexity of collateral management. According to Santander adoption of blockchain can save as much as $20bn a year from overhead costs attached to clearing and settlememts. Examples: Digital Asset Holdings with Hyperledger, Overstock with T0, Epiphyte, Clearmatics, SETL

First Movers

Traditional banking reached a milestone in October 2016, when 88 bales of cotton were purchased for $35k in a cross border blockchain based trade. In the past 2 years, banks have seriously begun exploring blockchain technology for integration into their exisitng systems and have been using multiple options to do so: starting from inhouse labs to investing in blockchain startups to participating in platform based consortia to alligning with tech companies. Central banks too, on their part have begun to scratch the surface both from a regulatory and applicability standpoint.

Base Software Platforms

Ripple, created by blockchain start-up Ripple Labs, is payments, currency exchange network with a native currency called XRP (ripples). It offers a cryptographically secure end-to-end payment flow with instant transaction verification allowing banks to directly transact minus intermediaries (correpondent banks, central counterparties).

Ethereum, is an open source distributed computing platform featuring a native cryptocurrency, called Ether, and smart contract functionality with several functioning applications built on it. Thus it makes it possible for developers to build and publish next-generation distributed applications.

Consortia

R3CEV - is a consortium, including 70 of the world’s biggest banks/FIs, working towards deployment of blockchain technology. The consortium created Corda, an open-source distributed ledger platform, geared towards implementation in the banking industry.

Hyperledger Project – led by Liniux is a consortium of 40+ members including a mix of financial, technology and blockchain companies. It is focused on blockchain based protocols and standards witha modular approach that supports different appplications. Also it has allowed other players to incubate their projects within it e.g. Blockstream’s linconsensus, IBM’s Fabric

Banks

Initially Banks started exploring viability cryptocurrencies and created their own: Goldman Sachs’ SETL coin for instant post-trade settlement, Citibank’s CitiCoin, Bank of New York Mellon’s BKoins and JP Morgan’s bitcoin-alernative “web cash” payments system. UBS has a cryptocurrency lab attempting to build a enterprise-wide product “utility settlement coin” with Clearmatics and has also claimed 30-35 blockchain use cases. Bank of America is seeking 35 blockchain-related patents including a cryptocurrency wire transfer and transfer payment system. Banco Santander has an inhouse team called Cyrpto 2.0 that has claimed 20-25 use cases for blockchain. Citibank has invested in a blockchain start up called Cobalt. Barclays has partnered with Bitcoin exchange Safello to develop blockchain based services. Goldman Sachs and JP Morgan have investd in blockchain Axoni, that rivals R3, and addition to investing in another blockchain firm Digital Asset. Dutch Banks like ABN Amro, ING are exploring blockchain with Rabobank having partnered with Ripple. Australian/Kiwi banks CBA,ANZ Bank, Westpac have partnered with Ripple whereas Westpac’s VC arm Reinventure has invested in startup Coinbase. Indian banks like ICICI, Axis Bank and Kotak Mahindra have all tested blockchain transactions.

Central Banks

Central Banks from Canada to China, England to Europe, Sweden to Singapore are researching establishment of a central bank issued cryptocurrency that will allow finacial instruments (bonds, equities, land & car registries) to migrate to the sovereign blockchain. US Federal Reserve has just released its first reseacrh on blockchain technology. Deutsche Bundesbank, German central bank, in partnership with Deutsche Borse are develpong a blockchain prototype for securities settlement leveraging over Hyperledger platform. Singapore Central Bank, along with 8 local/foreign banks have been involved in a blockchain based pilot projet with the help of R3CEV. Bank of Japan and ECB (an inital sceptic) have partnered for a new joint research project to study the potential use cases of blockchain. Banque de France has also begun testing use of blockchain to establish identity of creditors within Single Euro Payments area. Cashless society is a reality in most Nordic countries which is why Nordic central banks are considerring going all in with digitial currencies.

Technology Firms

Microsoft has allied with Bank of America to to create a blockchain based framework that can be sold to other organisations. Also, Project Bletchley by Microsoft is a Azure based modular blockchain fabric. IBM has launched a cloud based blockchain service. Alphabet is backing Ripple, which includes other technology firms like Seagate Technology and Accenture. Accenture has even patented a blockchain that can be edited. Microsoft, Alphabet, Intel, IBM and Amazon are all making a play to bring financial services to their cloud. Ex-Google engineer is working on Vault OS, a blockchain based operating system for banks.

0 Comments.